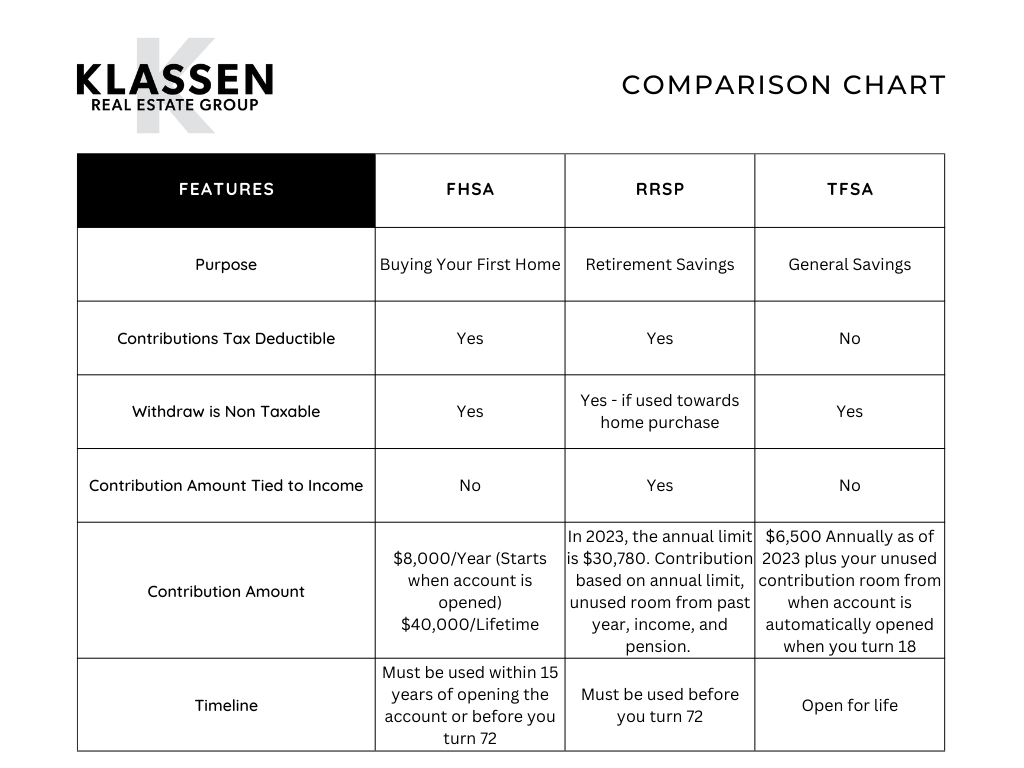

The FHSA, is a hybrid financial tool that combines the benefits of the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP) aimed to assist first-time home buyers enter the real estate market. First-time homebuyers can benefit from tax-free returns, tax-deductible contributions, and tax-free withdrawals when purchasing a home. You must be a resident of Canada and cannot have purchased a home before. There are contribution limits, with a yearly limit of $8,000 and a lifetime limit of $40,000 that must be used before you turn 72 or 15 years after you open the account (whichever comes first). Once you open the account, any unused contribution room from the $8,000 yearly limit can be carried forward, allowing contributors to catch up in subsequent years. For example, if you contribute $4,000 in 2024, in 2025 you can contribute $12,000 toward the account.

Here are a few links that may be helpful: