KNOW WHAT YOUR SALE PRICE WILL BE BASED ON DAYS ON MARKET!

Pricing your home correctly is one of the most important aspects of selling your home, and it can also be one of the most difficult. If you price your home too high above market value, you risk discouraging serious, qualified buyers. If you price your property below market value, then you’ll likely drum up a lot of interest, however, the offers and negotiations may ultimately get you less for your home.

- The market will always adjust to your home’s true value.

- Get the true market value upfront from a realtor who truly investigates the market so you understand where you need to be.

- Other factors in the marketability of your home: Terms and performance of your realtor.

- Price can be a “cure all” for problems a home may have. Every home has a price that will break open the market with buyers!

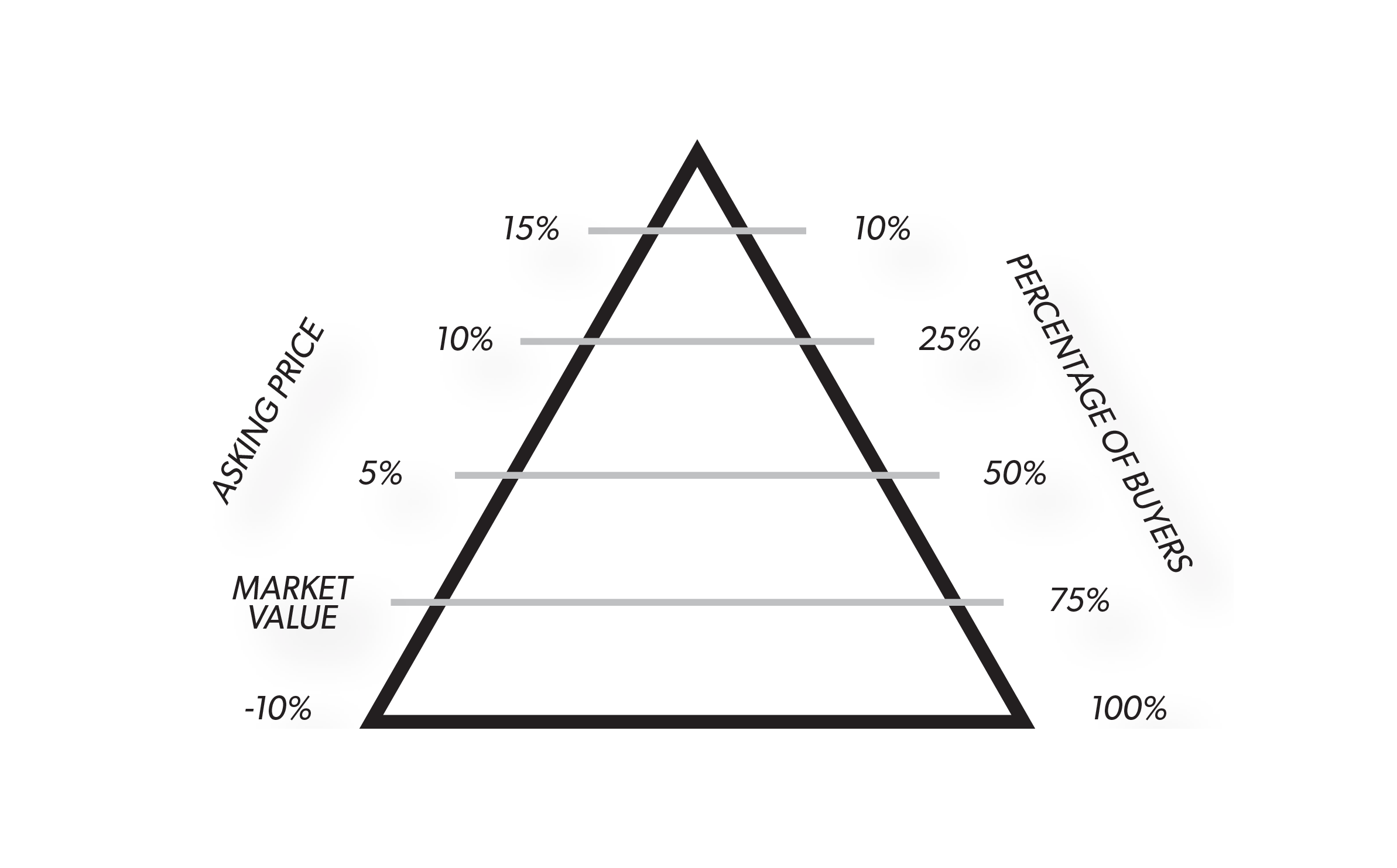

The property pricing pyramid demonstrates the balance in determining your property’s true market value. As the home’s asking pricing increases above market value, the percentage of potential buyers who will look at the property decreases. When the asking price starts to dip below market value, the percentage of potential buyers who will view the property increases.

30 DAY PRICE (Our Most Common Choice)

This is your market value or “slightly below” market value price.

75% of all homes listed for sale are above the market value. Market value is determined by comparable homes that have sold.

To sell faster, you must compete with a better, more competitive price.

Market value is based primarily on location, square footage, and condition.

Realtors are motivated to call their clients and tell them about the home, rather than waiting for the buyers to read an MLS email update sent by the Realtor.

60 DAY PRICE

This is slightly above your market value price.

Just adding “negotiating room” can trigger a longer wait time before selling.

90 DAY PRICE

Realtors say it is overpriced or use terminology like “seller priced” and may avoid viewing.

Often, choosing this price will require you to adjust your price downward throughout the listing process of 90 or more days!

Buyers see your house sit on the market and wonder what’s wrong with it.

The hassle of always being ready to show.

You most likely will sell your home for even lower than market value by starting too high. This option is not recommended in most cases.